How to Tackle the 7 Most Common Mistakes in the Site Selection Process

- 22 Jul 2020

Implementing an Effective Corporate Location Strategy While Maximizing Economic Incentives

Successful companies have learned that well-designed economic incentives can elevate a good site to an exceptional location. They’ve also learned that no amount of economic incentive can make the wrong site the right choice. Learn why the analytical site selection process shouldn’t be short-circuited by shiny objects such as random economic incentives, certain statistics, following competitors or newspaper headlines.

Successfully Navigating the Site Selection Process

Site selection is a process that demands both analytical and qualitative techniques to determine the most favorable locations for a business operation. Failure to properly apply either technique will likely result in suboptimal results.

Site selection decisions have immediate and long-term implications on cash flow, tax structure, cost of goods sold (COGS) and overall profitability. Recently, several factors have emerged to make site selection increasingly complex, including pandemics, changing environmental legislation, tightening labor availability, scarcity of certain labor skills, and an increasingly competitive economic incentive environment. These new complexities require careful consideration and a higher degree of analysis to minimize risk.

Thanks to the internet, the availability of location data, demographics, zoning and infrastructure is often only a few clicks away. Unfortunately, mountains of data are not enough to make smart site selection decisions.

Without proper tools to analyze, interpret and qualify data, you are likely sidelining your search for the most optimal location due to avoidable risks, delays and hidden costs. Corporate site selectors must be vigilant through every step in the process or risk compromising the final location selection.

Some of the critical mistakes that can easily occur during the site selection process are outlined below. These errors can undermine your strategy leading to increased risk, higher costs and squandering the chance to maximize incentives.

Shifting Project Requirements: One common mistake that a project team can make is shifting project requirements mid-stream without restarting the search process from the beginning. One observation we often hear from economic developers is that the final site that was selected is radically different from what they were initially told the client was looking for in terms of project requirements. There are numerous reasons for updating project requirements, including changes in key assumptions; however, not restarting the process from the beginning will surely inadvertently eliminate numerous eligible sites.

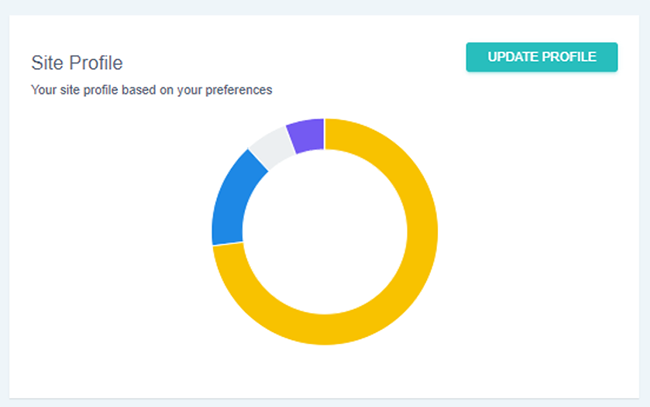

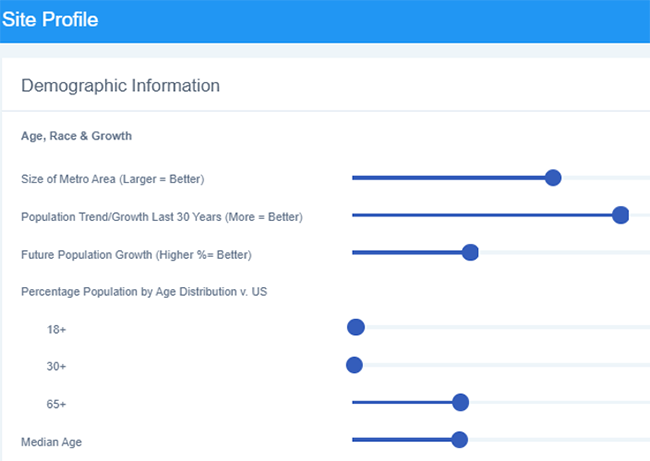

SITE Selector Solution - The Site Profile tool makes it easy for site selector teams to initially establish project requirements and promote buy-in, early on from corporate leadership throughout the process. Any changes made to the project requirements are automatically tracked and the rankings of potential sites updated, ensuring that suitable sites are not inadvertently eliminated from the search.

Wrong Search Area: Due to the sheer size of the U.S., some site selectors use publicly generated data to begin their search and narrow their potential locations. If you select the wrong variables, you risk narrowing your search too quickly. For example, there are 392 Metropolitan Statistical Areas (MSAs) in the U.S. According to the Federal Government’s Office of Management and Budget (OMB), all counties that are not part of an MSA are considered rural. Based on the last census, non-metro counties contained 46.2 million people, about 15% of the total population and covered 72% of the land area of the country. Therefore, if you focus your search solely on MSA-level data, you’ll be missing most of the country’s land area and 15% of the population. A seemingly innocuous decision at the front-end of the process can lead to large gaps in the search data, inadvertently eliminating hundreds of suitable communities from your search.

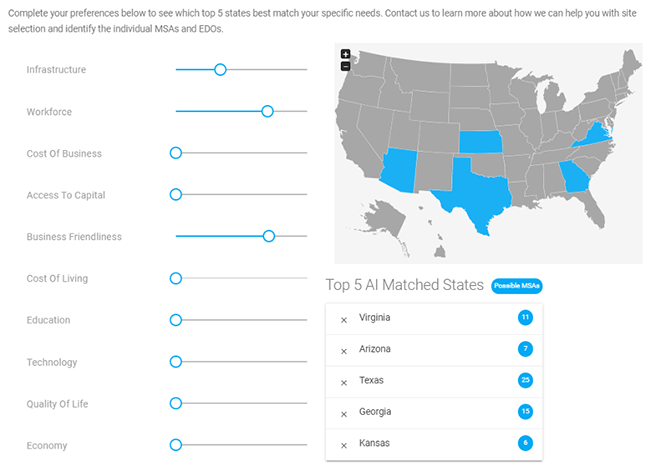

SITE Selector Solution - The StateFinder tool starts your search with a broad focus allowing you to test different assumptions before drilling down. Results are automatically updated based on adjustments made to the slider. States that have been eliminated can be easily excluded from suggested search locations. Our methodology has been designed to evaluate the suitability of a state prior to consideration of any particular community. We believe it’s critical to analyze data from a variety of sources to obtain community insights from a local, MSA and state-level perspective. As the search continues, the lens we use to evaluate and rank sites, changes.

Focusing on Listed Properties Exclusively: Tools like Loopnet can be valuable in the search process, but they can overlook some of the best sites that are not publicly listed. Larger projects may require assembling many parcels, which makes the assembled parcel unlikely to be found on any website. Furthermore, if you are looking to maximize the dollar value of economic development incentives, you’ll likely miss the most compelling opportunities if you don’t expand your search. Since the great recession, economic development organizations (EDOs) have increased their efforts to assemble and market vacant and abandoned properties, which are a significant drag on local economies but have a potential for business growth, job creation and community revitalization. Today, many EDOs have the resources required to repurpose distressed land and buildings. These resources often include substantial discretionary incentives designed to attract potential employers to the community. If your search ignores publicly controlled sites, you’ll miss out on the properties that the communities are the most motivated to redevelop.

SITE Selector Solution - By matching projects directly with state, regional and local economic development offices, we identify sites that are privately- and publicly-held. Our data-driven approach allows us to focus solely on finding the best sites regardless of who controls them.

Assuming Communities Are Not Interested: Many small and medium-sized firms assume they are too small to attract the attention of EDOs, let alone secure meaningful economic incentives.

SITE Selector Solution - As communities begin recovering from COVID-19, the competition to attract jobs is rapidly increasing. When projects are added to the Marketplace, an Expression of Interest questionnaire is automatically sent to the matched state, regional and local economic development offices. Recently, a small metal-processing-manufacturing plant with a capital expenditure (capex) budget of $2 million, which was expecting to hire 10 employees, received interest from 50 wide-ranging communities across the country.

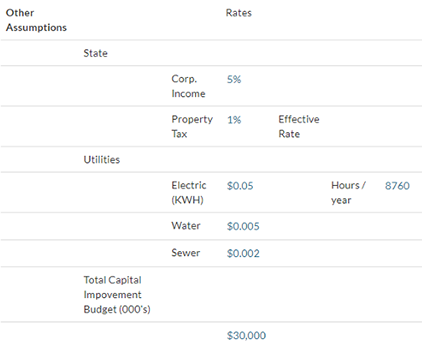

Not Having Integrated Pro Forma Models: Regardless of how large or small your project is, a proper pro forma financial model is required to calculate your company’s preferred metrics. Not having integrated models makes testing key assumptions difficult, time-consuming and fraught with opportunities to make mistakes.

SITE Selector Solution - Our “Living Pro Forma” is integrated directly into each site’s Deal Book, providing unparalleled transparency. Our model permits authorized users to test key assumptions or download onto their machines.

Leaving Incentives on the Table: Although virtually every city in the country has some sort of economic incentive program, all incentives are not the same. Furthermore, the application and qualification process customary for incentive programs are complex, non-standardized and time-consuming, causing many firms to skip them entirely due to frustration.

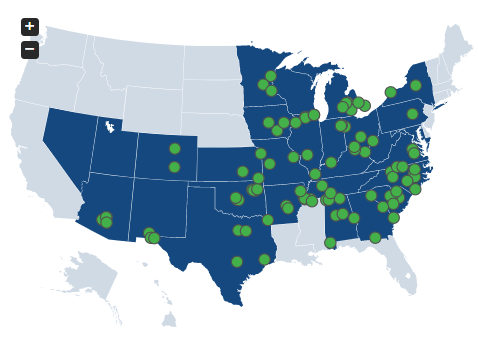

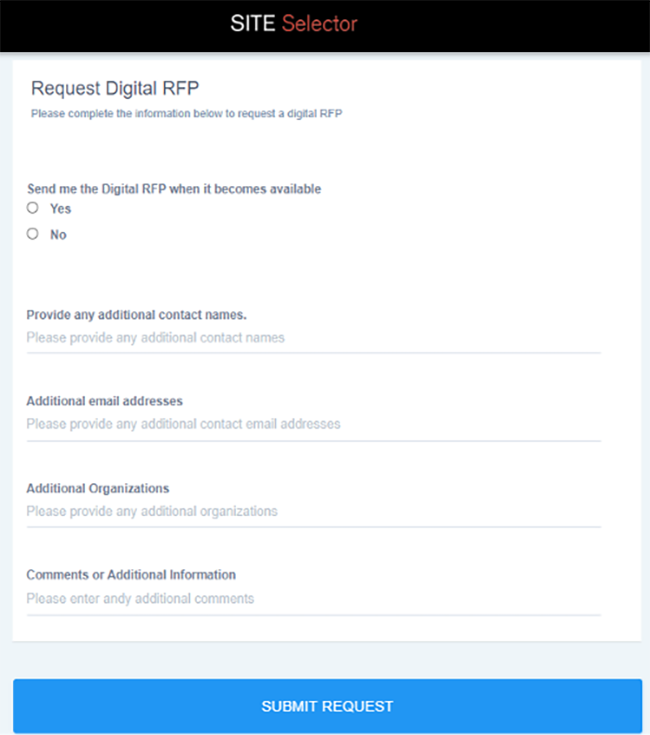

SITE Selector Solution - Our electronic RFP gives site selectors the power to efficiently solicit economic incentives directly from hundreds of communities across the country with the click of a button. You control when to ask for incentives—at the beginning of a project or after you’ve created your shortlist. The digital RFP is particularly useful for discretionary incentive programs that are designed to be customized to meet specific project needs. Once your shortlist has been created, Duff & Phelps’ professionals will ensure you’ve secured the best site while maximizing the economic incentives available.

Not Collecting Awarded Incentives: According to the Brookings Institute, each year between $45 billion and $90 billion of various federal, state and local incentives are offered for the purpose of job creation and attracting capital investment related to economic development. Surprisingly, it is estimated that in any given year, less than half of the incentives offered are collected by the companies that had secured them. In a study that examined incentives awarded vs. incentives taken by companies, the research found that during 10 years, the maximum amount of incentives realized was 40%.1 According to Gregory Burkart, Managing Director and leader of Duff & Phelps’ Site Selection and Incentives Advisory practice, there are several reasons for incentives to remain uncollected. Beyond the obvious reason of changes in the client’s core business, there are numerous self-inflicted/ preventable mistakes that are common.

- Miscommunication: The old saying “beware of the devil in the details” remains true in the world of economic incentives. Good intentions alone from both recipient companies and EDOs are not enough for a successful outcome. The specific performance requirements must be clear from the beginning, so there is a clear understanding of all program requirements and strings attached. There is also miscommunication internally at companies. It’s not uncommon for the executive who negotiated the incentives to move to a new position without memorializing the deal or its performance measures.

- Strings Attached: It’s not uncommon for an organization to be awarded incentives without understanding the overall process and time/effort required to satisfy program requirements. In some communities, the administrative burden of the incentive programs can become overwhelming and not worth the value received, especially with incentives spread over multiple years.

- Dedicated Compliance Personnel: Typically, the team of professionals that are tasked with securing the incentives are not the same people that are tasked with compliance. Without a single point person to manage incentive programs from beginning to end, it is easy for the responsibility of compliance to get “lost” within the organization.

- Wrong Incentive Programs: For senior management, it is easy to focus on the headline describing the generous incentives package awarded. However, if the EDO you are working with doesn’t truly understand your organization’s needs, it can cause them to incorrectly offer incentives that ultimately prove useless. This often occurs many times with non-refundable tax credits that become stranded on a balance sheet when the company does not have a projected tax liability.

SITE Selector Solution – As the SITE Selector platform digitizes the site selection process, it has been able to provide a level of standardization that has been previously unseen in the industry. Standardization allows for efficiency in matching projects to communities and matching companies to the right incentive programs. Standardization allows Duff & Phelps’ site selection professionals to assign ratings to incentive programs, making it easier for companies to assess their likely realized value. Additionally, our platform allows companies to centralize their data, documents and processes for helping internal stakeholders to communicate with each other and ensure program compliance. Finally, integrated checklists and communication tools aid companies to meet bureaucratic obligations, simplifying the process of collecting incentives earned. If you choose to engage an external third-party firm to manage compliance, we can configure our API to share all relevant data upon request.